Ethereum Price Prediction: $7,500 in Sight as Institutions Accumulate

#ETH

- Technical Breakout: ETH trades 12% above 20-day MA with Bollinger Bands suggesting $4,800 near-term target

- Institutional Validation: Public companies now hold 3% of ETH supply, with $130M+ recent acquisitions

- Sentiment Shift: Whale activity and treasury strategies point to $7,500+ long-term valuation models

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerging

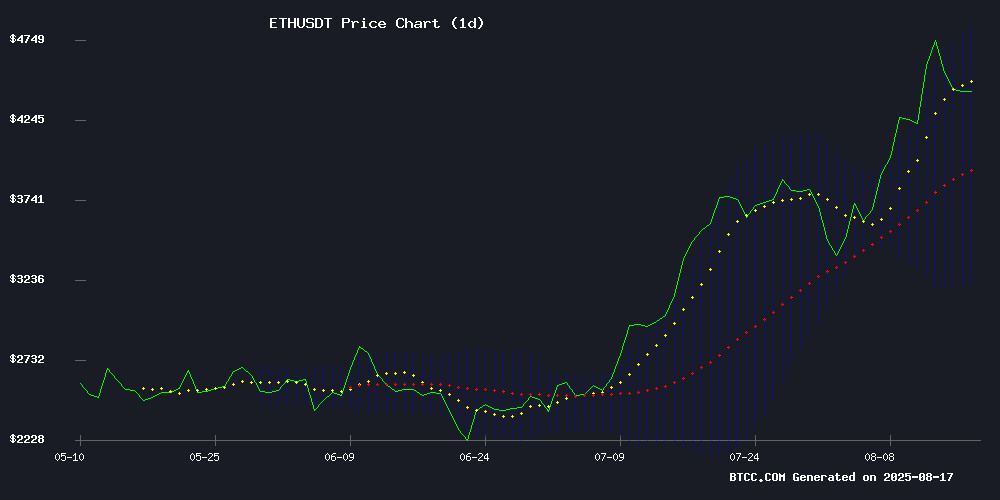

ETH is currently trading at $4,520.66, significantly above its 20-day moving average of $4,031.02, indicating strong bullish momentum. The MACD remains negative but shows narrowing bearish divergence (-409.27 vs -240.41), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band at $4,855.85, with the middle band at $4,031.02 serving as support.says BTCC analyst William.

Institutional Demand Fuels Ethereum Optimism

Corporate accumulation of ETH (now holding 3% of supply) and whale activity dominate market sentiment. BitMine's $130M purchase during recent dips and SharpLink's $2.6B treasury strategy reflect institutional confidence.notes BTCC's William.ETF inflows slowing suggests retail may be waiting for clearer signals.

Factors Influencing ETH's Price

Public Companies Accumulate Ethereum Reserves, Holding Over 3% of Supply

Publicly traded firms are aggressively accumulating Ethereum, with corporate treasuries now holding more than 3.7 million ETH worth approximately $17 billion. This represents over 3% of Ethereum's total circulating supply, signaling growing institutional confidence in the asset.

BitMine Immersion Technologies leads the pack with 1,150,263 ETH acquired after a $250 million private investment round. The mining company, chaired by Fundstrat's Tom Lee, pivoted from Bitcoin-focused operations to establish a dedicated Ethereum treasury strategy.

The trend mirrors earlier Bitcoin adoption patterns among corporations, but with notable figures like Ethereum co-founder Joe Lubin actively promoting ETH's value proposition to institutional investors. Other major holders include SharpLink Gaming and Coinbase, though specific reserve figures for these firms remain undisclosed.

Ethereum Whales Fuel Bullish Momentum With $15K Target in Sight

Ethereum's market outlook is being reshaped by institutional demand, ETF inflows, and Layer 2 adoption. Analysts suggest that the combination of deflationary supply and aggressive whale accumulation could propel ETH into one of its strongest rallies yet.

Whale activity has surged, with one address linked to DeFiance Capital purchasing 30,366 ETH worth $114 million in just 28 hours. Tom Lee of Fundstrat Global Advisors predicts Ethereum could reach $15,000 by December, citing its growing institutional appeal.

Ethereum Price Prediction at $7,500—Ozak AI’s ROI Potential Looks Much Higher

Ethereum continues to dominate as the backbone of decentralized finance (DeFi) and Web3, powering a vast array of decentralized applications, NFT platforms, and smart contracts. Analysts project a bullish trajectory, with $7,500 emerging as a plausible target for ETH by 2025. Achieving this level would mark a 150% gain from current prices, pushing Ethereum's market capitalization beyond $900 billion.

Layer-2 scaling solutions like Arbitrum, Optimism, and zkSync have significantly enhanced network efficiency, reducing transaction costs and increasing throughput. These advancements, coupled with the expanding DeFi ecosystem and tokenization of real-world assets, solidify Ethereum's position as the cornerstone of blockchain-based finance.

While Ethereum's potential gains are substantial, emerging projects such as Ozak AI are capturing attention with even higher ROI prospects for early investors. The contrast between established giants and innovative newcomers underscores the dynamic opportunities within the crypto market.

Ethereum Eyes $4,700-$4,800 Breakout Amid Bullish Momentum

Ethereum's price surge above $4,500 has ignited bullish sentiment among analysts, with technical indicators pointing to a potential breakout toward $4,700-$4,800 in the coming week. The cryptocurrency currently trades at $4,541.38, showcasing strong upward momentum despite overbought conditions.

Key resistance levels loom at $4,788, while support holds firm at the 20-day SMA of $4,032. A deeper floor exists at $3,354 should market conditions shift. Analyst consensus remains overwhelmingly positive, with CoinCodex projecting a 9.90% gain to $4,687.90 within five days and DigitalCoinPrice targeting $4,776.22 based on EMA buy signals.

The breakthrough of April's uptrend channel resistance line signals the potential for an extended impulse wave. This technical development, coupled with ETH's decisive move above the psychological $4,000 barrier, suggests the rally may have room to run toward $5,000+ territory.

BitMine Acquires $130M in Ethereum Amid Market Downturn

BitMine, the crypto investment powerhouse led by veteran strategist Tom Lee, has seized the market downturn as an opportunity to bolster its Ethereum holdings. The firm purchased 28,650 ETH worth approximately $130 million through over-the-counter transactions, avoiding public exchanges to prevent price disruptions.

This acquisition elevates BitMine's total Ethereum reserves to 1.174 million ETH, valued at $5.26 billion, cementing its position as one of the largest institutional holders of the asset. The OTC strategy reflects a growing trend among sophisticated investors to accumulate positions discreetly, mirroring Wall Street's playbook for large-scale asset acquisition.

Ethereum's long-term growth potential appears undiminished in BitMine's eyes, despite short-term volatility. The move signals strong institutional confidence in ETH's fundamentals, even as retail investors retreat during market corrections.

Ethereum Whale Activity Fuels Hopes for $5,800 Price Target

A significant Ethereum whale accumulation has sparked bullish sentiment in the market. An unknown entity created three new wallets and purchased 92,899 ETH, worth approximately $412 million. Such large-scale accumulation often signals strong confidence in future price movements.

Ethereum is currently trading at $4,468.57, with a 0.28% increase in the last 24 hours. The cryptocurrency must hold the $3,370 support level to eye a potential breakout toward $5,800. Derivatives data shows rising open interest but a sharp drop in trading volume, indicating cautious optimism among traders.

The market cap stands at $538.31 billion, with a 24-hour trading volume of $46.95 billion, reflecting steady participation. Analysts are closely watching key technical levels, suggesting a major price move may be imminent.

SharpLink Gaming Expands $2.6B Ethereum Treasury Strategy

SharpLink Gaming, Inc. has aggressively expanded its Ethereum holdings, acquiring over 728,000 ETH in Q2 2025. The Minneapolis-based firm now ranks among the largest publicly traded corporate holders of Ethereum, signaling a broader shift toward cryptocurrency adoption in corporate treasuries.

The company's strategic vision gained momentum with the appointment of Ethereum co-founder Joseph Lubin as Chairman and former BlackRock executive Joseph Chalom as Co-CEO. These leadership changes underscore SharpLink's dual focus on blockchain innovation and institutional-grade asset management.

SharpLink's treasury strategy reflects growing institutional confidence in Ethereum's long-term value proposition. The 728,804 ETH position, valued at approximately $2.6 billion, demonstrates how digital assets are being integrated into traditional corporate finance frameworks.

Ethereum ETFs See Inflows Slow After Initial Surge

Ethereum's spot ETF launch ignited institutional demand, with $3.7 billion flooding into products from BlackRock, Fidelity, and Grayscale within eight days. The frenzy pushed ETH toward its all-time high at $4,093 before momentum waned.

Friday's $59.3 million outflow signals potential profit-taking as staking withdrawal queues lengthen. Analysts remain cautiously optimistic—Nansen's Jake Kennis notes sustained flows could maintain the rally, while traders observe 'institutional FOMO' in vertical inflow charts.

The slowdown presents a critical test for ETH's market leadership. Unlike broader crypto assets, Ethereum continues attracting disproportionate institutional interest despite the cooling ETF demand.

Ethereum Price Prediction: Can ETH Reach $15,000 Soon?

Ethereum has weathered a turbulent year, with its price plunging to $1,300 earlier in 2024 before rebounding to $4,400. Analysts suggest the worst may be over, citing "seller exhaustion" and shifting investor sentiment. The potential approval of U.S. Ethereum ETFs with staking features, championed by BlackRock, could catalyze significant gains.

Eric Jackson of EMJ Capital argues that the early-year selloff created a foundation for recovery. With short positions unwinding and institutional interest growing, Ethereum's trajectory appears poised for upward momentum. The integration of staking in ETFs would offer regulated exposure while compounding yield—a dual appeal for institutional and retail investors alike.

Ethereum Consolidates Near $4,459 as Institutional Demand Fuels Bullish Sentiment

Ethereum (ETH) holds steady above $4,450, buoyed by record ETF inflows and upward price revisions from major analysts. The cryptocurrency's resilience follows a $3 billion surge in spot Ethereum ETF inflows this month, outpacing Bitcoin products and signaling growing institutional confidence.

Standard Chartered's revised year-end target of $7,500 reflects mounting optimism, while technical indicators suggest potential for a breakout toward $4,788 resistance. Corporate accumulation patterns reveal entities like Bitmine Immersion Technologies and Sharplink Gaming have acquired over 2 million ETH since June, reinforcing Ethereum's fundamental strength.

Despite neutral RSI readings at 66.50, the market structure favors bulls as ETH consolidates near all-time highs. The $4,000 psychological barrier's recent breach establishes new support levels, with traders now eyeing Standard Chartered's ambitious $12,000 long-term projection.

Trump Emerges as Nobel Contender on Crypto Prediction Markets

Prediction markets built on blockchain technology are reshaping how geopolitical events are forecast. Polymarket and Kalshi, two decentralized platforms, now place Donald Trump as a top contender for the 2025 Nobel Peace Prize—a development sparking both intrigue and skepticism.

Trump currently holds 11-13% odds across these platforms, trailing only Yulia Navalnaya. The markets, fueled by cryptocurrency traders, reflect speculative sentiment rather than institutional consensus. Polymarket's use of blockchain highlights crypto's growing influence in unconventional data analytics.

This phenomenon underscores how crypto-native platforms are creating alternative information markets. While traditional Nobel predictors rely on academic consensus, blockchain-based markets aggregate crowd wisdom—and gambling impulses—through mechanisms like ETH-based prediction contracts.

How High Will ETH Price Go?

Technical and fundamental factors align for potential upside:

| Target | Basis | Timeframe |

|---|---|---|

| $4,800 | Bollinger Upper Band + Institutional Breakout Zone | 1-2 weeks |

| $5,800 | Whale Accumulation Pattern | 1-3 months |

| $7,500 | Corporate Treasury Valuation Models | 6-12 months |

"The $4,500-$4,700 consolidation is healthy," William observes. "With MACD turning and whales accumulating, we could see 15-20% moves in August. The $15K predictions require ETF inflows returning to Q2 levels."

$4,520.66

$4,031.02 (11.2% premium)

Converging bearish momentum

3% of circulating supply